Let’s take a walk down memory lane for 2017, shall we? Using the budget from each month as well as our shared Google calendar, it’s easy to see what we did and where we spent money throughout the year.

Even though we teach this stuff, our 2017 was not perfect. We did do a budget every month but some months had unexpected expenses that caused us to dip into our emergency fund – which is precisely what it is there for. However…we also chose to use our emergency fund to buy some furniture on clearance (with an even better cash discount), and to give a couple of really nice gifts during the year. Those were choices we made and while the fund never dipped below three months of expenses, it still got lower than we want. One of our goals in 2018 is to have more in savings for emergencies and for car replacement.

We did good in funding both of our IRAs; as part of the 15% of our income going into retirement savings we put in almost the max per normal IRA ($5500 each) but not the max allowed for our age, which is $6500 each. We will increase the amount going into our IRAs to $6500 each once our mortgage is paid in full which should be in the next 3-4 years.

The growth in our mutual funds (net of fees) beat the S&P 500 by 8.48% proving yet again that it is VERY possible to pick mutual funds that “beat the market”. The funds we’ve picked have consistently beat the S&P 500 every year, with the exception of the one time I tried to get fancy (read: greedy) and go against the advice of investing only in good growth stock mutual funds. We also track our overall net worth and it is increasing at a good pace between reducing the mortgage (our only debt), the increase in property values, investing 15% into mutual funds, and the growth in value of those funds.

The growth in our mutual funds (net of fees) beat the S&P 500 by 8.48% proving yet again that it is VERY possible to pick mutual funds that “beat the market”. The funds we’ve picked have consistently beat the S&P 500 every year, with the exception of the one time I tried to get fancy (read: greedy) and go against the advice of investing only in good growth stock mutual funds. We also track our overall net worth and it is increasing at a good pace between reducing the mortgage (our only debt), the increase in property values, investing 15% into mutual funds, and the growth in value of those funds.

We planned for and paid cash for a master bath remodel. We completed renovation on a couple of other rooms, paying as we go and will continue that into 2018.

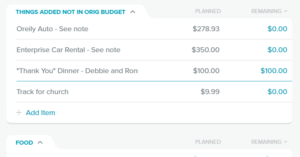

One of the most interesting changes we are implementing for 2018 is adding a budget category for Things Not In The Original Budget. Remember that with a Zero-Based Budget you lay out everything you are going to spend money on before the month begins. Well as many of you know, it seems that every month “something” comes up. And that’s fine, that’s just life. But you have to account for it somewhere in the budget. So, instead of wedging it into a standard category, these new things will now go into a new category named Things Not In The Original Budget. This way we can track month by month where we missed an entry when building the original budget and how many of these things were just (ahem) impulse Amazon purchases by me. Almost always by me. Some would argue that these items are perfect for a Miscellaneous category and I think they are, this is just one way to further track the spending and our Miscellaneous category will go away.

How about you? Do you do a recap of the year to see where you came from, what you accomplished, and what you can do better?

Recent Comments