by David | Apr 23, 2018 | Budgeting, Debt, Insurance, Retirement |

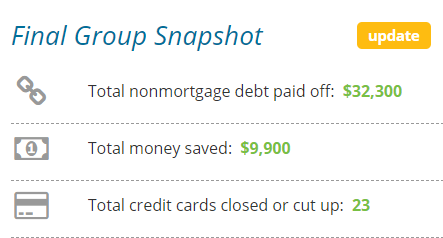

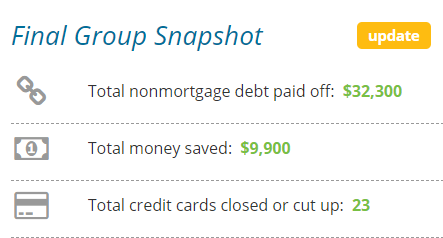

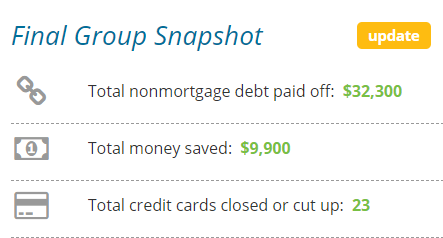

We recently wrapped up our 10th session of Financial Peace University. We have offered it 2-3 times a year for the last several years at our local church in Galveston County. I wanted to take a moment and share the results that we turned in to Ramsey Solutions of how...

by David | Apr 16, 2018 | Budgeting, Debt |

This “great deal” illustrated above recently popped up on a shopping deals site I visit from time to time. It’s at best a 2% cash back credit card (but read the fine print…). Everything you need to know about how these things work in reality, and why they are a...

by David | Apr 9, 2018 | Debt |

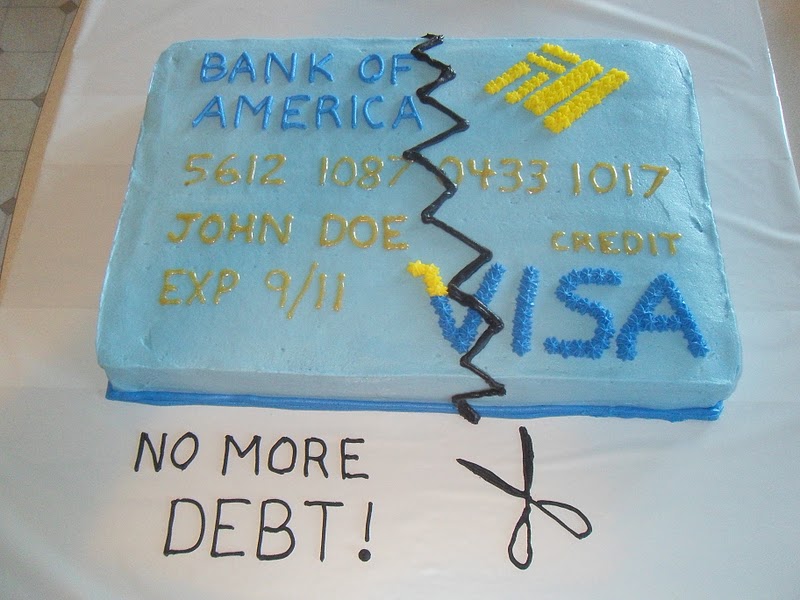

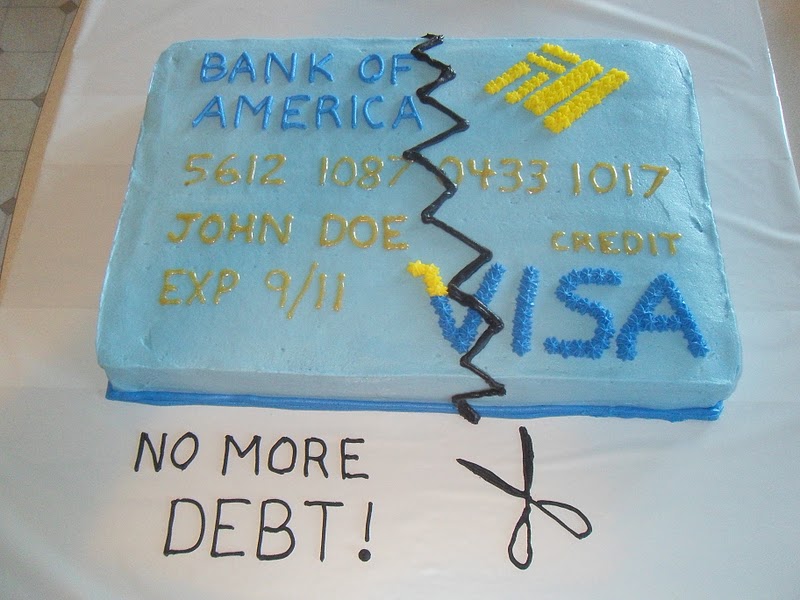

April 4 marked four years that we have been debt free, everything but our mortgage. It took us 6.5 years to pay off 23 accounts consisting of credit cards, car loans, and student loans. After calculating the interest during that time the total amount paid back was 3x...

by David | Apr 3, 2018 | General |

Debit and Credit cards with European Mastercard & Visa (EMV) chip technology have been around for a while (note that the USA was well behind other countries in adopting this more secure technology). But what is the best strategy to use? There is no difference in...

by David | Mar 26, 2018 | General |

There’s a new trend amongst app-using folks wanting to Do Better With Money, the idea of automatically investing small amounts of money on a very frequent basis. For example, when you make a purchase and pay with your debit card, an app would round the purchase up to...

by David | Mar 19, 2018 | General |

Does the thought of filing your taxes scare you more than The Exorcist? Tax time is upon us. You must, by law, pay tax on every dollar of income you earn. We all know that, but what does it mean and what happens if you don’t? This is a very quick, simple post on...

by David | Mar 13, 2018 | Retirement |

Awhile back we had dinner with two other couples and we were decidedly the youngest people there. And we’re not exactly spring chickens. The host was a retired banker and the subject of personal finance came up, of course. He started talking about reverse...

by David | Mar 5, 2018 | Budgeting, Insurance |

Insurance is the subject we all love to hate. But the fact is, some insurance is absolutely necessary. You should never look at insurance as a way to save or invest. Insurance does not make you money. Insurance costs you money, to protect the things (assets) that...

by David | Feb 26, 2018 | Debt |

The headline of a recent article on student loans proclaims, “Student loan borrowers with high debts aren’t making progress repaying them”. File this under, “Thank you, Captain Obvious. What was your first clue??” Student loans are just one of many, many ways we as a...

by David | Feb 19, 2018 | Budgeting, General |

I think no matter your current relationship with personal finance, you can look into the future and anticipate what you may need to buy. It could be as simple as a set of tires in the next year, or replacing the entire car in the next 2-3 years. If you can identify...

by David | Feb 12, 2018 | Debt |

Credit cards. Student loans. Car payments. YUCK! Debt of any kind sucks but especially consumer debt. If you have made the decision to pay it off, to GET OUT, then you may have read some helpful tips already, such as: get a second job (or just work more in general),...

by David | Feb 5, 2018 | Retirement |

Pensions are a dying breed of retirement vehicle as more and more companies and institutions move away from an employer-owned retirement fund to an employee-owned 401k or similar. For those at or nearing retirement age, at some point you will have The Meeting with the...

by David | Jan 29, 2018 | General |

We hear about it from our clients and students, we read about it in various coaching and financial blogs / groups we belong to. “They” say you can’t rent a car with a debit card. Well, you can. And we did. We were geared up to take a trip over New Year’s, about a four...

by David | Jan 22, 2018 | Retirement |

There are several articles and sites that will calculate what you should have saved for retirement at every age during your career. For example, by age 40 you “should” have 3x your annual household income. For a household earning $75,000 a year, that would be $225,000...

by David | Jan 15, 2018 | General |

As we begin a new year, what is the number one “thought” you have about money? Is it a fear? A hope, desire, or goal? When you think about money where does your mind instinctively go? Here are some examples we’ve heard from students and clients: Most that we talk to...

Recent Comments