by David | Jul 16, 2018 | Budgeting, Retirement |

In a recent MSN article basketball great Shaquille O’Neal describes what he learned from his father about the money he was making as an NBA superstar: in a nutshell, he said that it won’t last forever and his dad was on him to do a good job saving and investing it....

by David | Jun 4, 2018 | Budgeting, Retirement |

CNN Money reports that 56% of married women leave investment and long-term financial planning decisions to their husbands, and 85% of women who defer to their husbands believe their spouses know more about financial matters. It’s one thing to be the “nerd” in the...

by David | May 14, 2018 | Budgeting, Debt, Retirement |

We are casually shopping for new-to-us cars, about 2-3 years old. We are not at all in the market for new cars. Why, you might ask? Because on average a new car loses 42% of its value in the first three years.1 That’s literally turning $30,000 into $17,000 in three...

by David | Apr 23, 2018 | Budgeting, Debt, Insurance, Retirement |

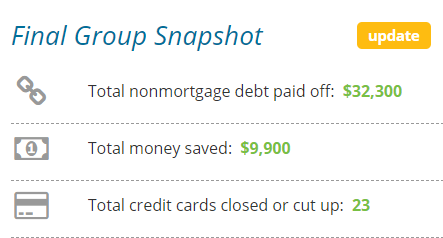

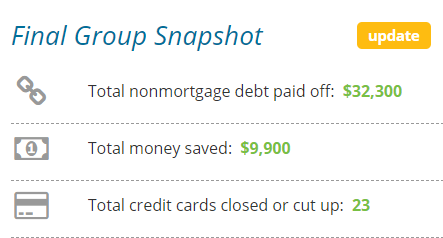

We recently wrapped up our 10th session of Financial Peace University. We have offered it 2-3 times a year for the last several years at our local church in Galveston County. I wanted to take a moment and share the results that we turned in to Ramsey Solutions of how...

by David | Apr 16, 2018 | Budgeting, Debt |

This “great deal” illustrated above recently popped up on a shopping deals site I visit from time to time. It’s at best a 2% cash back credit card (but read the fine print…). Everything you need to know about how these things work in reality, and why they are a...

by David | Mar 5, 2018 | Budgeting, Insurance |

Insurance is the subject we all love to hate. But the fact is, some insurance is absolutely necessary. You should never look at insurance as a way to save or invest. Insurance does not make you money. Insurance costs you money, to protect the things (assets) that...

Recent Comments