by David | May 14, 2018 | Budgeting, Debt, Retirement |

We are casually shopping for new-to-us cars, about 2-3 years old. We are not at all in the market for new cars. Why, you might ask? Because on average a new car loses 42% of its value in the first three years.1 That’s literally turning $30,000 into $17,000 in three...

by David | Apr 23, 2018 | Budgeting, Debt, Insurance, Retirement |

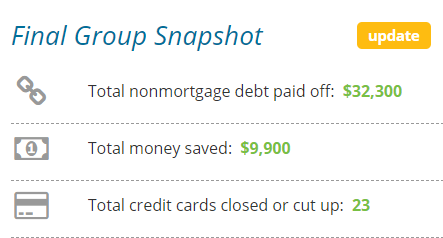

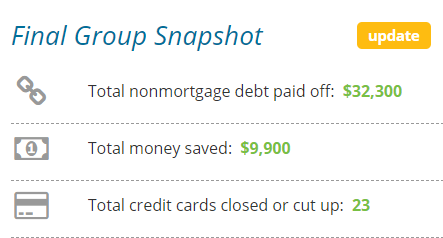

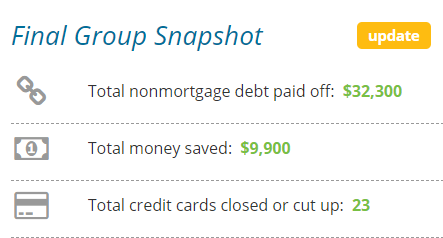

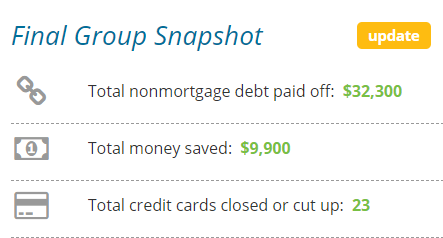

We recently wrapped up our 10th session of Financial Peace University. We have offered it 2-3 times a year for the last several years at our local church in Galveston County. I wanted to take a moment and share the results that we turned in to Ramsey Solutions of how...

by David | Mar 13, 2018 | Retirement |

Awhile back we had dinner with two other couples and we were decidedly the youngest people there. And we’re not exactly spring chickens. The host was a retired banker and the subject of personal finance came up, of course. He started talking about reverse...

by David | Feb 5, 2018 | Retirement |

Pensions are a dying breed of retirement vehicle as more and more companies and institutions move away from an employer-owned retirement fund to an employee-owned 401k or similar. For those at or nearing retirement age, at some point you will have The Meeting with the...

by David | Jan 22, 2018 | Retirement |

There are several articles and sites that will calculate what you should have saved for retirement at every age during your career. For example, by age 40 you “should” have 3x your annual household income. For a household earning $75,000 a year, that would be $225,000...

by David | Jan 4, 2018 | Budgeting, Retirement |

Let’s take a walk down memory lane for 2017, shall we? Using the budget from each month as well as our shared Google calendar, it’s easy to see what we did and where we spent money throughout the year. Even though we teach this stuff, our 2017 was not perfect. We did...

Recent Comments