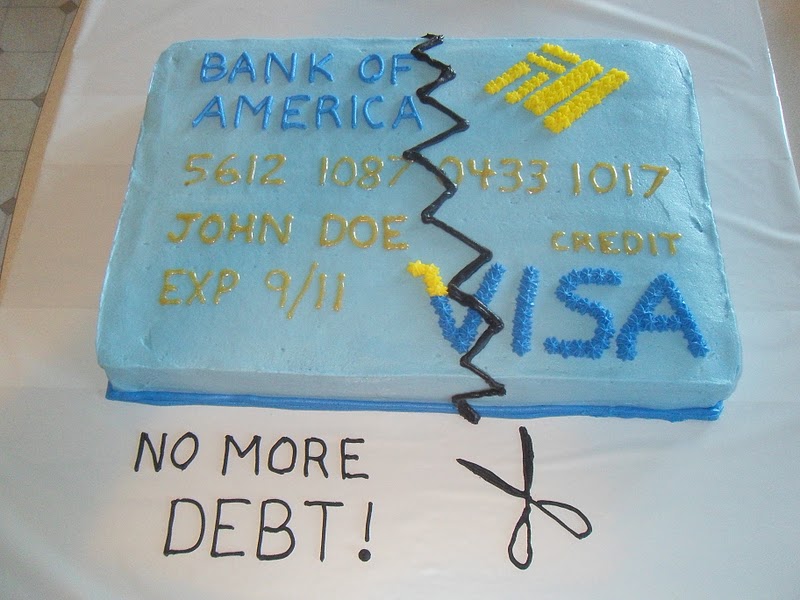

April 4 marked four years that we have been debt free, everything but our mortgage. It took us 6.5 years to pay off 23 accounts consisting of credit cards, car loans, and student loans. After calculating the interest during that time the total amount paid back was 3x our gross annual income at the time.

That’s a lot of cheese no matter who you are. A majority of our income was tied up every month going to banks to pay for stuff we already had.

So what is the purpose of paying off debt? Do you pay off all your credit cards, student loans, and car loans – only to run out to the dealership and finance a brand new car? No, that would be stupid. “You’re always going to have a car payment” is the mantra of the middle class. And to the extent that you believe that, you will never win with money. Yes we will replace our cars in just about 12 months – paying cash for a couple of 2-3 year old cars. I’m sure we’ll blog about the experience when we buy them, LOL.

“You’re always going to have a car payment” – Things broke people say

The purpose of becoming and staying debt-free is so that you can direct your income toward things that appreciate in value such as mutual funds and real estate. Wealth, in other words. Your income is your most powerful wealth-building tool. Don’t give it all to banks in the form of credit card payments and car loans.

In the four years since becoming debt-free our net worth has increased by nearly 3x our gross annual household income. We are able to fully invest for our future. we are able to give money to things that are important to us. THAT’S why we became debt-free.

Recent Comments